Vrtno Orodje Bonsaj Lopato Orodja Komplet Vrtne Škarje Z Rokavice Za Vrtnarjenje Darila Z Trowel Pruners Multi-Funkcionalne Vrt Kit popust ~ Center / Pk-termeptuj.si

Popust 10 kosov vrtnarsko orodje, vrt ročno orodje, s knjigovodsko polje za vrtnar (zelena) obrezovanje škarje vrtne potrebščine najboljše darilo \ Orodja / www.hafi.si

Novo Leseno Vrtno Orodje Igrače Za Otroke, Ustvarjalne DIY Orodja za Popravilo Pretvarjamo, Igrajo Inženiring Vzdrževanje Škatla za Orodje Igrače Fantje Darila nakup ~ Center - Afina.si

EFEKT ergonomic tools - ****vsak dan ZADENI EFEKT PRO vrtno orodje**** ****na FB objavi delovni EFEKT SELFIE**** Opomba: Vsak dan bomo izžrebali enega srečnega nagrajenca, ki bo brezplačno prejel na dom izdelek

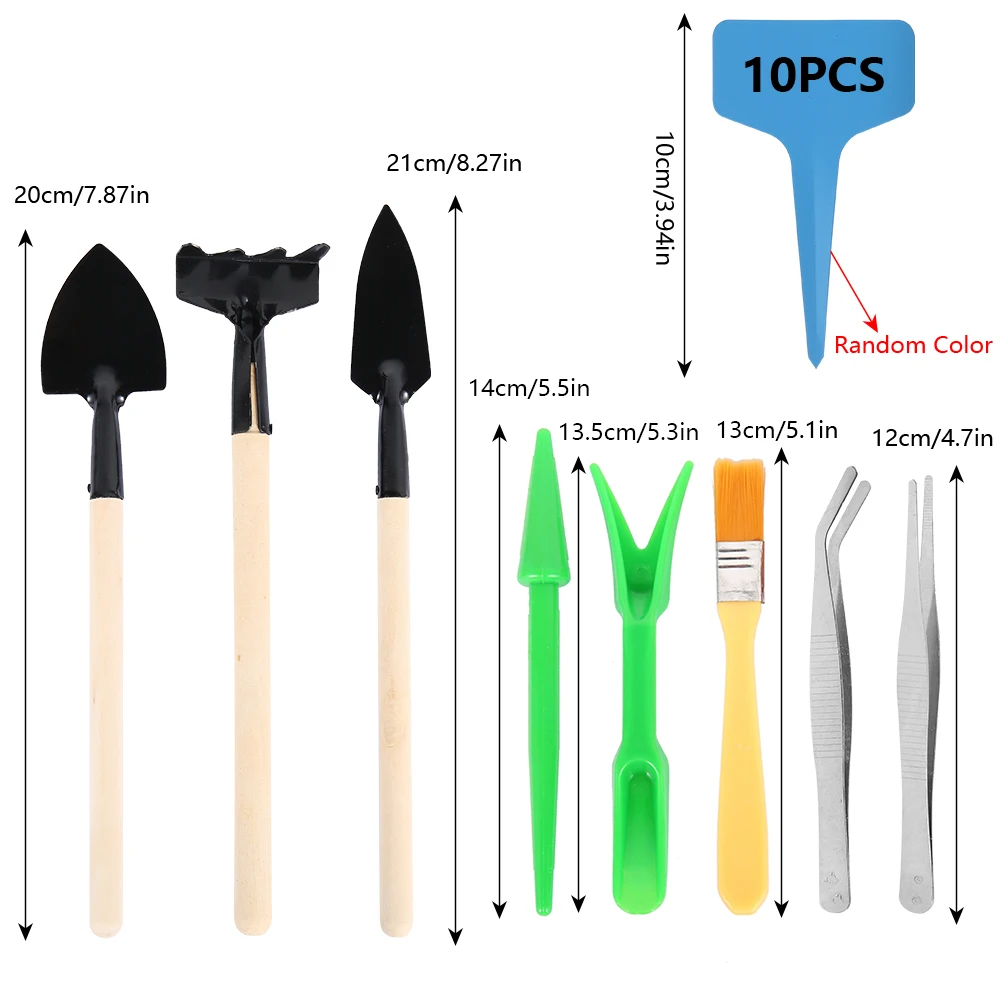

10pcs Miniaturni Vrt Orodje Ročno Nastavite Sočna Presajanje Pravljice, Vrtno Orodje, Sajenje Z 20 Rastlin Oznake Kot Darilo nakup na spletu ~ center - www.plc.si

Mali Vrtnar Orodje Set Z Vrečko Otroci Otrok Vrtnarjenje Fantje Dekleta Darilo Vrt Igrače Za Otroke Z Vrtno Orodje Rokavice Na razprodaji! > Orodja / www.picerija-lesjak.si

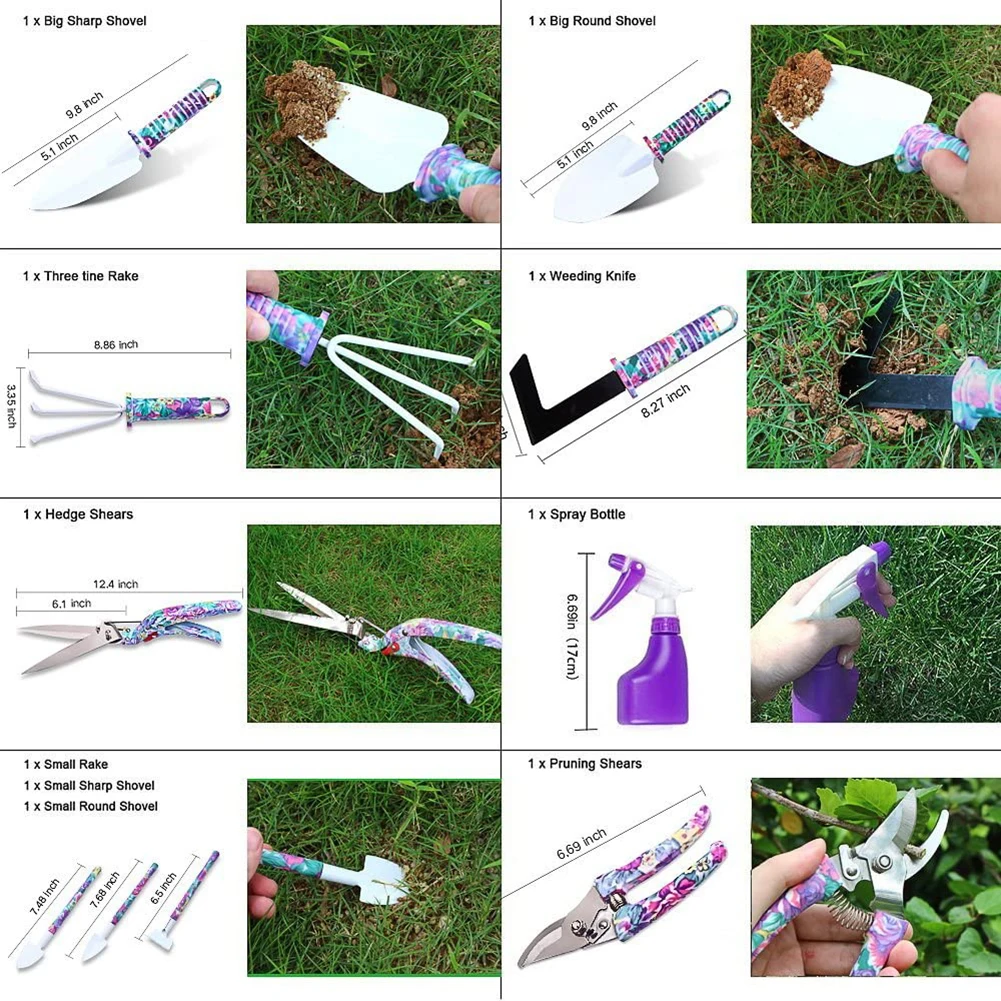

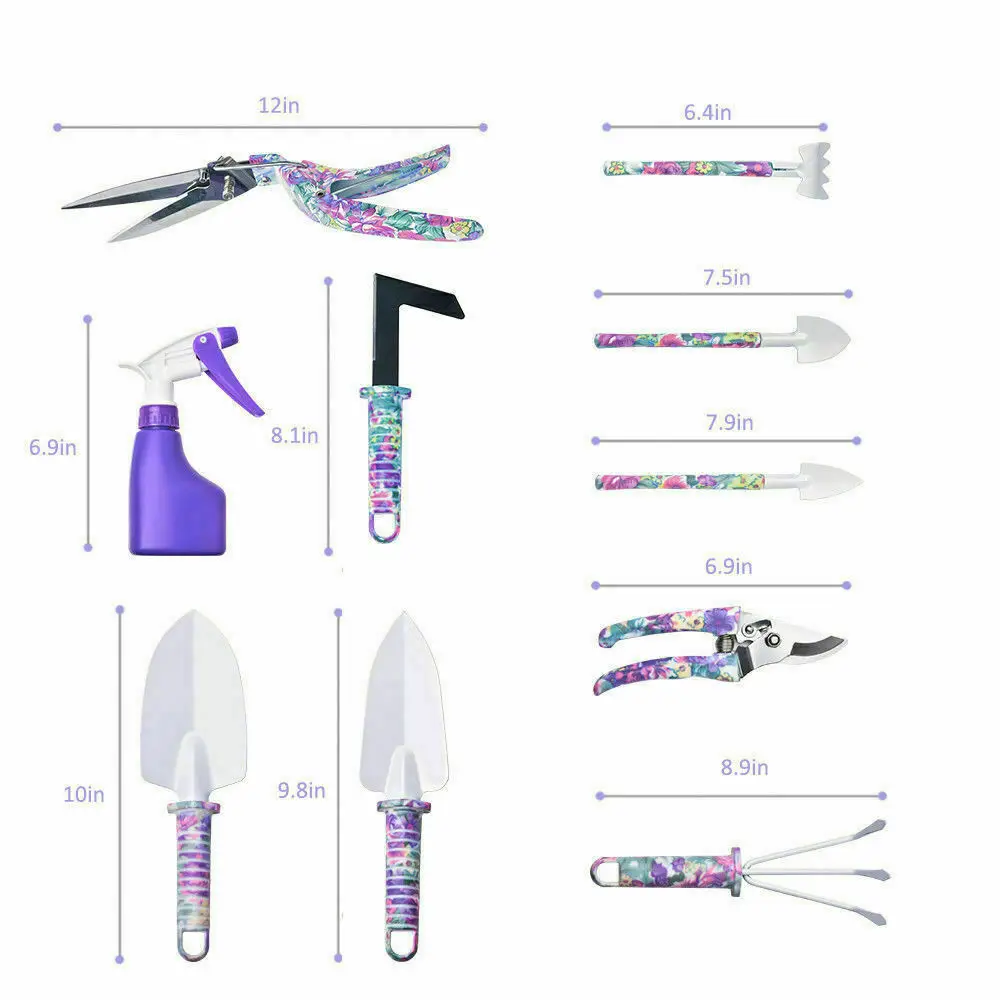

10pcs Vrtno Orodje Set Lahki Vrtnarjenje Orodja Komplet Pruner Trowel Presajanje Lopato, Grablje Spray Steklenico Z Box Darilo nakup na spletu ~ center - www.plc.si

10pcs miniaturni vrtnarjenje ročno orodje set sočna presajanje pravljice, vrtno orodje, sajenje, z 20 rastlin oznake kot darilo naročilo \ najboljši - Vitaminz.si

Naročilo 26pcs vrtno orodje igrače pretvarjamo, igrajo orodje za popravilo prejete okoljske inženirske plastike orodja za vzdrževanje darila za otroke \ Igrače & hobiji - www.tiskarna-kaucic.si

10pcs Vrtno Orodje Set Lahki Vrtnarjenje Orodja Komplet Pruner Trowel Presajanje Lopato, Grablje Spray Steklenico Z Box Darilo nakup na spletu ~ center - www.plc.si

Na razprodaji! 10pcs vrtno orodje set boxed non-slip iz nerjavečega jekla lahek ročaj vrt sušilniki za kompleti darilo vrt orodja sušilniki za kopanje ~ Popust < Trgovinayorki.si

10pcs Vrtno Orodje Set Boxed Non-slip Iz Nerjavečega Jekla Lahek Ročaj Vrt Sušilniki Za Kompleti Darilo Vrt Orodja Sušilniki Za Kopanje - popust > www.chlorys.si