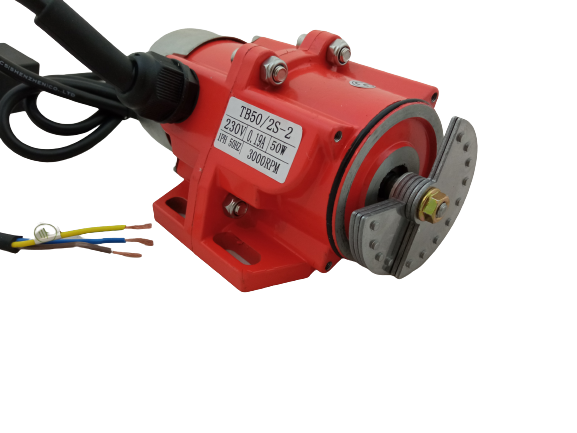

100W ~ 120W 110V/220V/380V silnik wibracyjny regulowana prędkość dla podajnik, maszyna do natryskiwania, maszyna do czyszczenia warzyw - AliExpress Home Improvement

.jpg_640x640.jpg?mini)

1 sztuk DC 12V silny silnik wibracyjny 3000RPM DIY przenośny masażer żaba karmienia dobry silnik tanie i dobre opinie

DC 24V 12V 7.4V silny silnik wibracyjny 6W 10W 3000-3400RPM DIY przenośny masażer żaba karmienie dobry silnik - AliExpress Home Improvement