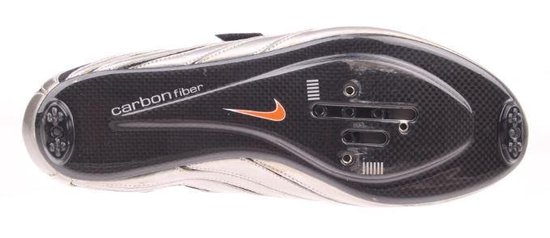

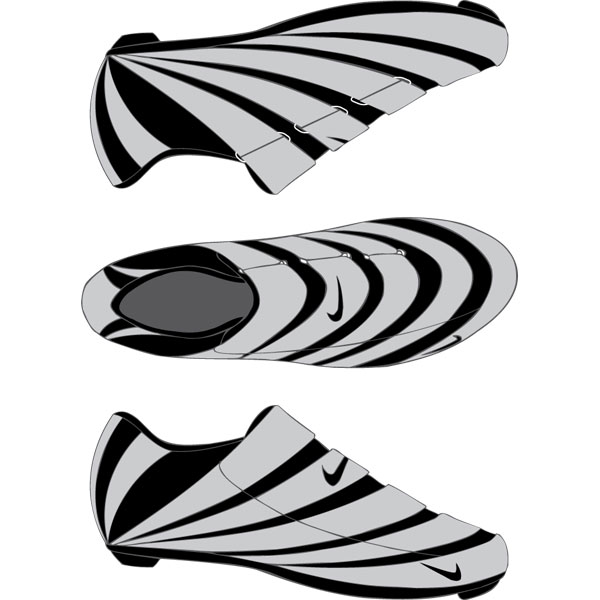

Nike Granfondo WRX Carbon Women's Road Cycling Shoes: Size 37EU - Two & 3 Bolt Cleats - Walkable - Grey/Black (NEW w/stains) - Bike Recyclery

Nike Granfondo WRX Carbon Women's Road Cycling Shoes: Size 37EU - Two & 3 Bolt Cleats - Walkable - Grey/Black (NEW w/stains) - Bike Recyclery

Nike DCLV Carbon Made in Italy Rennradschuhe Superrep Cycle in Bayern - Augsburg | eBay Kleinanzeigen ist jetzt Kleinanzeigen

Nike Granfondo WR Women's Road Cycling / Spin Shoes: Size 37 - Two Bolt Cleats - Walkable - Grey/Black (NEW) - Bike Recyclery