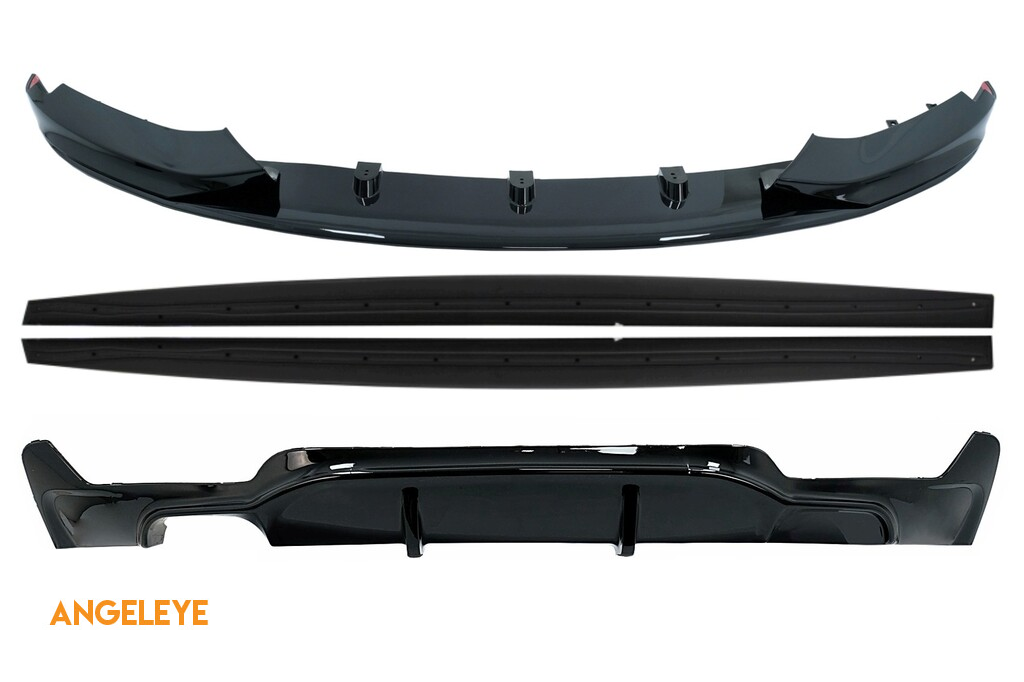

Prelungire Difusor Difuzor Spoiler Bara Spate BMW seria 3 E91 E90 Kombi Touring HA095 2005 2011 #41447

48cm partea de fusta prelungire bara spate canard divizor universal pentru bmw e90 e92 e93 325i 328i 320i 2008-2013 accesorii auto / Părți Exterioare < Online-licente.ro

Prelungire difuzor adaos evacuare tuning sport bara spate BMW E92 E93 320 Mtech Aero 2006-2012 ver1 - Servco Tuning Bazar | Servco Tuning Bazar