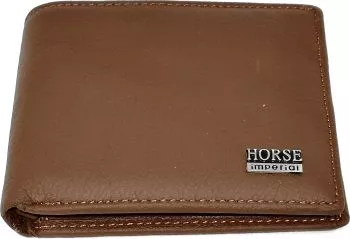

Portofel barbatesc, din piele naturala, Imperial Horse, compartimente multiple, maro - PR100 - Buticcochet.ro

Portofel barbatesc, din piele naturala, Imperial Horse, compartimente multiple, maro - PR100 - Buticcochet.ro

Portofel barbatesc, din piele naturala, Imperial Horse, compartimente multiple, negru - PR110 - eMAG.ro

Portofel barbatesc, din piele naturala, Imperial Horse, compartimente multiple, maro - PR100 - Buticcochet.ro

-650x650.jpg.webp)