Buy OEM Brand New SteelSeries QCK MASS Notebook Gaming Mouse Pad Computer Mouse Pad SteelSeries Mouse pad OEM 270*320*2mm in Nigeria - Rehmie.com.ng

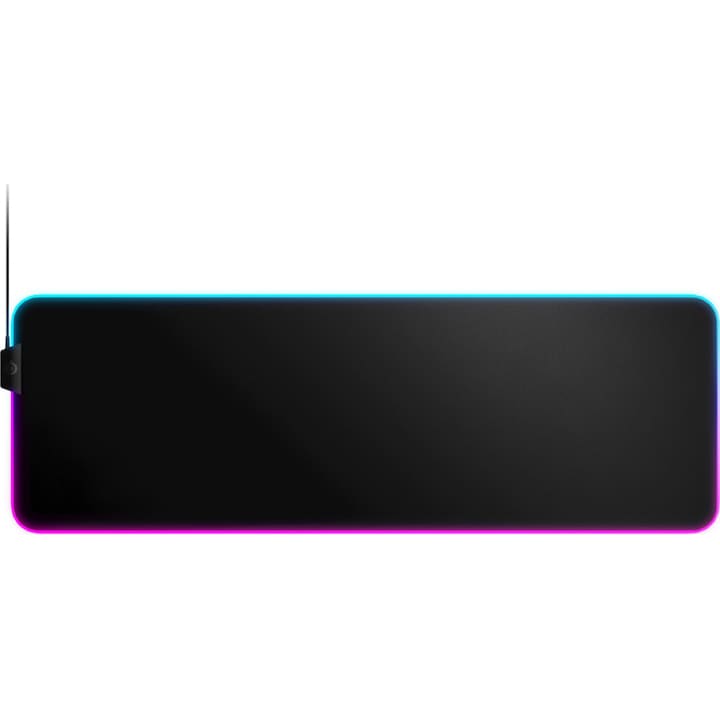

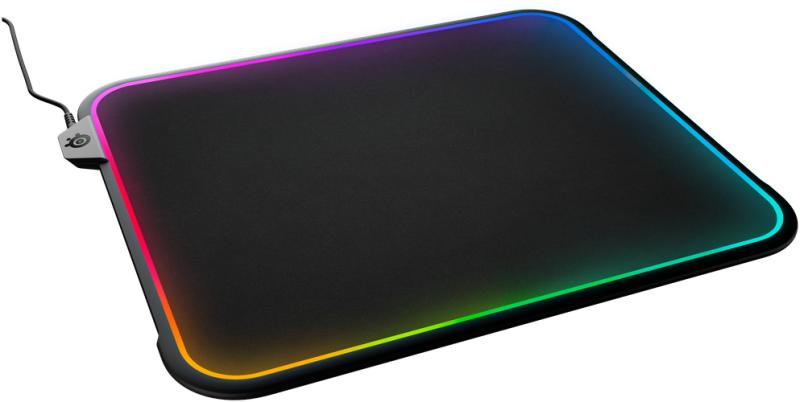

Vásárlás: SteelSeries QcK Edge Medium (63822) Egérpad árak összehasonlítása, QcK Edge Medium 63822 boltok

Promo SteelSeries Mousepad Gaming QcK Mass - Black 285x320x6 di Seller El Rasna Store - Kota Jakarta Barat, DKI Jakarta | Blibli

Vásárlás: SteelSeries QcK+ Pro Gaming (63003) Egérpad árak összehasonlítása, QcK Pro Gaming 63003 boltok

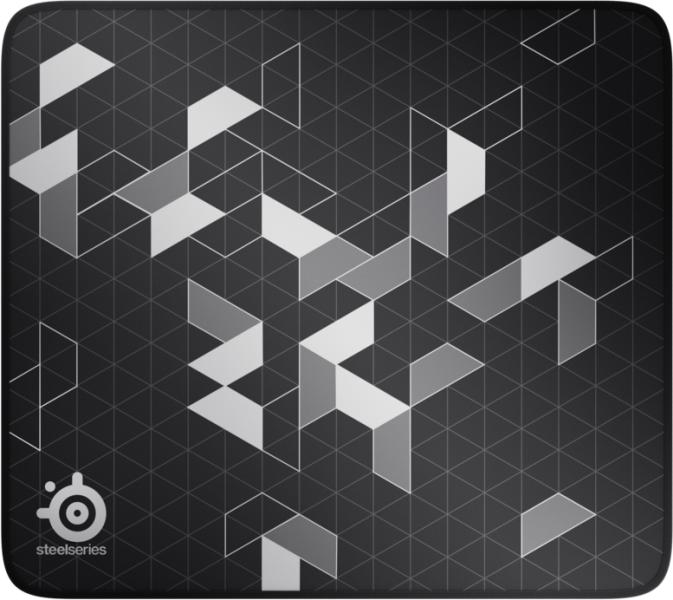

Amazon.com: SteelSeries PUBG QcK Gaming Surface - Large Cloth Erangel - Optimized for Gaming Sensors - Maximum Control : Video Games