Pentru Ins dragoste inima tort model oglindă acrilică tort fân tort fericit ornament aniversare de nunta petrecere desert decor > Home & Garden / Labordiagnosticatm.ro

7inch Mini De Aur Foita De Argint Număr De Baloane Tort Fân Diy Tort Steaguri Aniversare De Nunta Petrecere Decoratiuni pentru < Home & Garden > Maravelabusinessgroup.ro

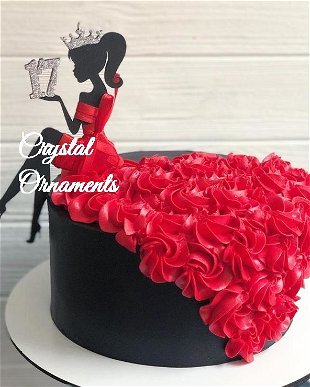

Pentru Doamna fata cupcake toppers, tocuri inalte tort joben, negru, desert tort ponturi pentru ziua de nunta desert prajitura > Home & Garden / Labordiagnosticatm.ro

-1000x1000.jpg)