Czajnik emaliowany FOLKLOR Emalia Olkusz - Garneczki.pl - czajnik ozdobą kuchni - akcesoria kuchenne - aranżacje kuchni - kuchenny.com.pl

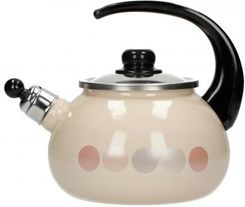

Emalia Olkusz Czajnik emaliowany z gwizdkiem OLKUSZ RÓŻOWE GROCHY 2,0 l beżowy - Opinie i atrakcyjne ceny na Ceneo.pl

Czajnik emaliowany z gwizdkiem 2,5 l kremowy PREMIUM Scandi Emajlo Olkusz / Czajniki emaliowane - naczynia.olkusz.pl

Czajnik emaliowany z gwizdkiem OLKUSZ PYZA NEW FOLKLOR 2 l - rabat 10 zł na pierwsze zakupy! | JakiPrezent.pl