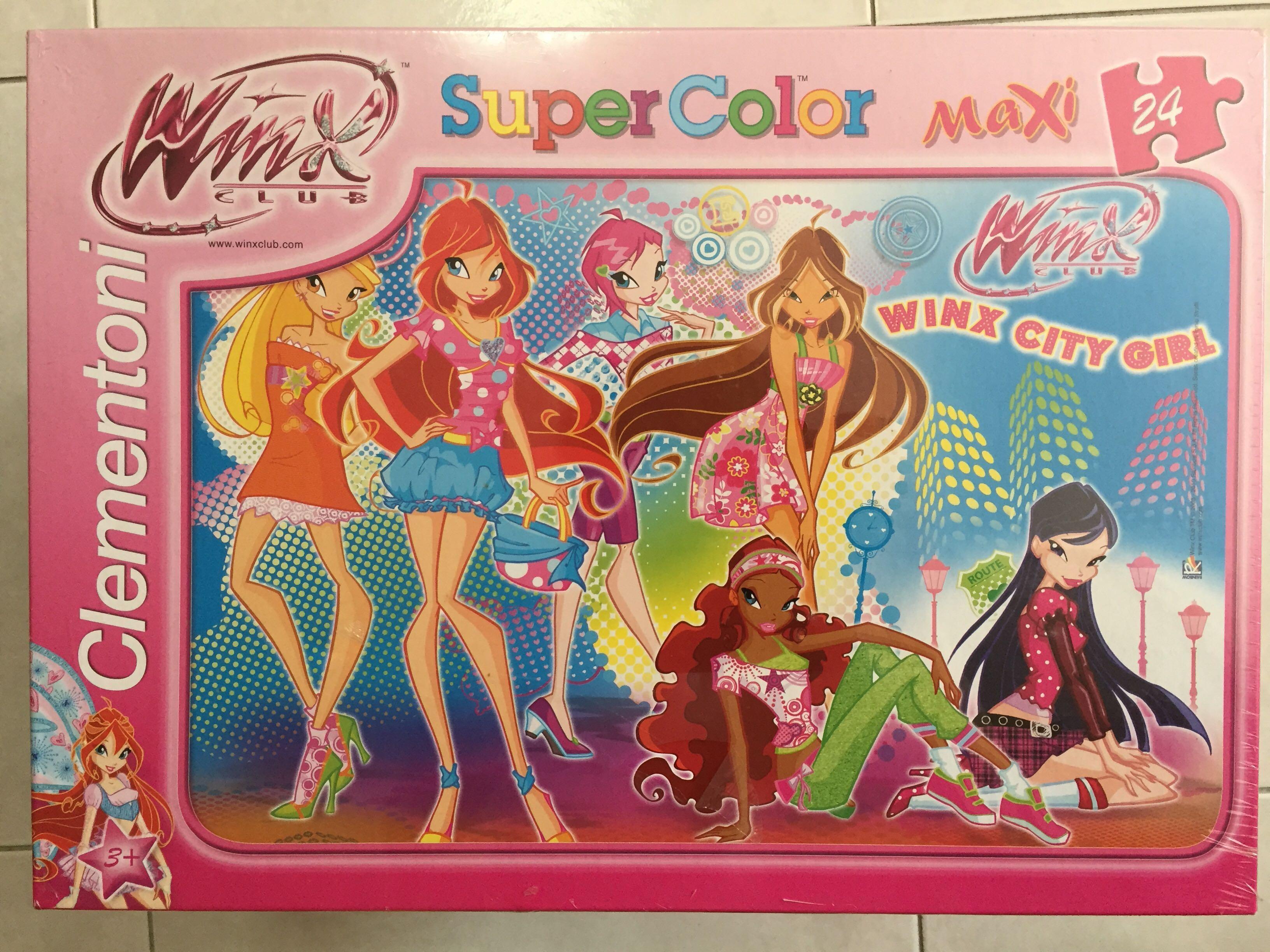

Nuevo puzzle Winx Club Trendy! New puzzle Winx Club Trendy! http://poderdewinxclub.blogspot.com.ar/2014/01/nuevo-puzzle-winx-cl… | Мультфильмы, Игровые арты, Аниме

Winx Club All on Twitter: "#WinxClub Season 7 PUZZLES!! SEE MORE HERE!-> https://t.co/LUKE9JVdn5 #winx #winxclub #winx7 #tynix #butterflix https://t.co/nmiokiflJL" / Twitter