Газова фурна OPTIMUS INTERNATIONAL Series6020 за каравана/кемпер | Варна | 5bg.top - Безплатни обяви - продавалник

Лодка Каравана RV Camper 2 горелки, ПРОПАН-бутан газови котлони печка и мивка, комбинирана с закалено стъклен плот 775*365*150/120 мм GR-904RS купи > Топ - Bargain-Global.cam

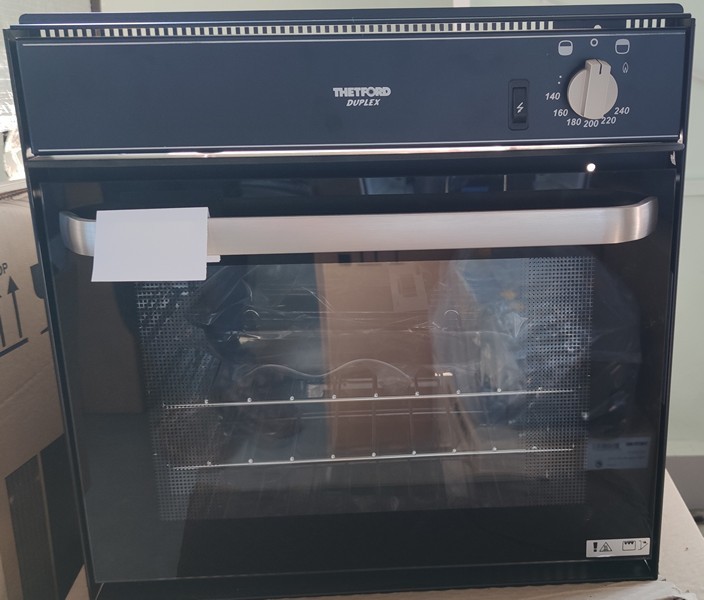

Газова фурна за вграждане с грил Dometic OG2000 - Къмпинг мебели и кухни - Къмпинг Продукти и Аксесоари за Кемпери и Каравани

Лодка каравана кемпер 2 горелки, пропан-бутан газови котлони печка и мивка комбо с закалено стъкло 790*375*150 мм Gr-216a | най-добрите / Magazin-Start.today