Nike Epic React Flyknit 2 Club Gold Black Red Orbit Metallic Gold BQ8928 - 700 - Nike Washed Teal Shoes - GmarShops

Nike Air Max 93 Huarache - StclaircomoShops - Nike Epic React Flyknit kobe 2 Blue Tint White Black Shoes CJ5930 - 114

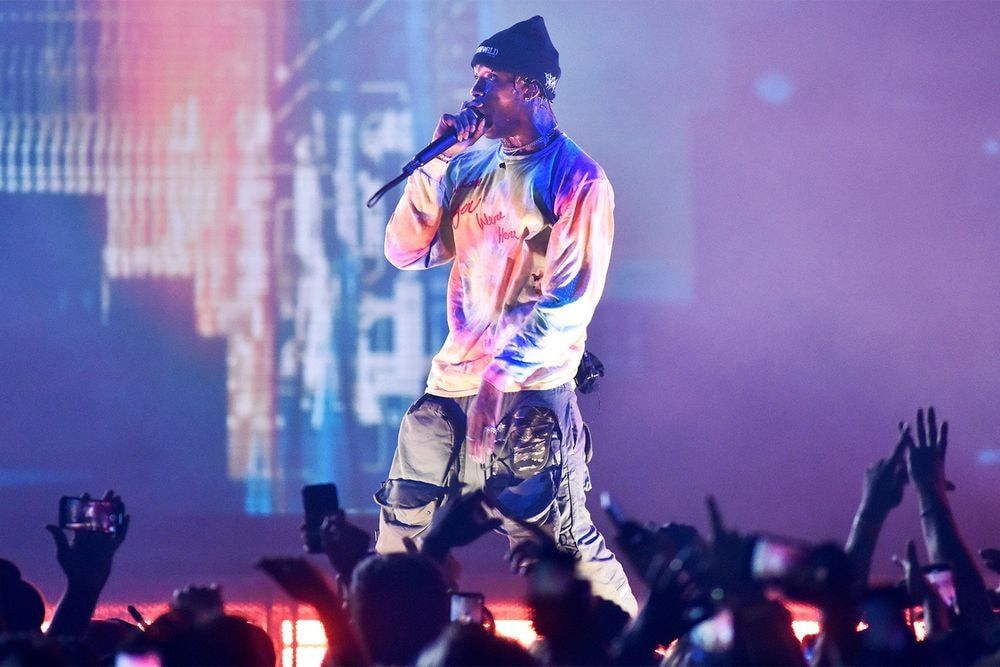

el producto Nike Air Max Command Flex Zapatillas Niño a pequeño a Blanco | Travis Scott and Nike Collaborate on Air Max 270 | Hypebae

Nike Zoom Kobe VII "Black History Month" First Look - BioenergylistsShops | nike air zoom vomero 15 for sale Pre - DC5330 - Day LX 'Hasta' - 301

Nike Air Max 90 Toggle SE - BillrichardsonShops | Schuhe Nike Court Force Beast Mid Shoes - new Schuhe nike epic react flyknit 3 black yellow orange

Nike Epic React Flyknit Vintage 2 Hydrogen Blue Black Lime Blast Sapphire BQ8928 - 453 - AljadidShops - Nike Air Max 90 Black Vibrant Yellow-Grey