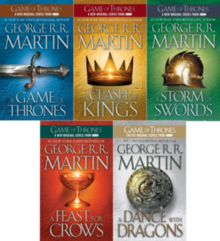

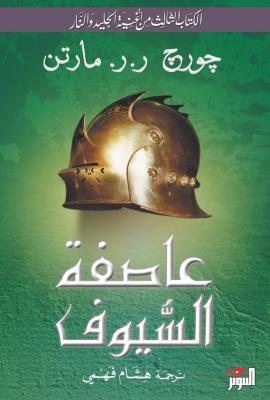

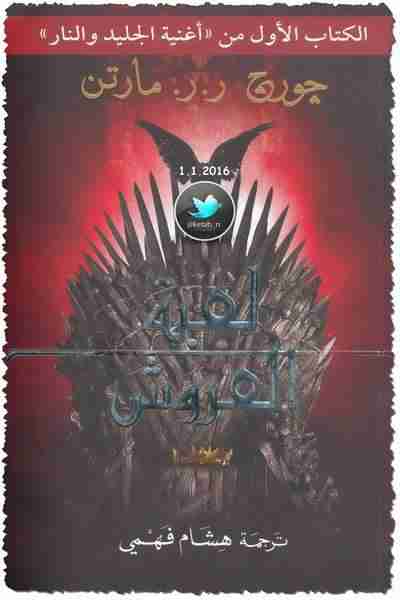

راكان الشايع na Twitterze: „اكثر الأسئلة اللي تتكرر علي (راكان من وين نجيب كُتب اغنية الجليد والنار؟ كم كتاب فيه؟ هل الكُتب مُترجمة؟ الأفضل النسخة العربية او الأنقليزية؟ كم سعر الكُتب؟ كيف

راكان الشايع na Twitterze: „اكثر الأسئلة اللي تتكرر علي (راكان من وين نجيب كُتب اغنية الجليد والنار؟ كم كتاب فيه؟ هل الكُتب مُترجمة؟ الأفضل النسخة العربية او الأنقليزية؟ كم سعر الكُتب؟ كيف