Amazon.com : IPL Cricket Jersey KKR Team Supporter T-Shirt 20-21 Half & Full Sleeve Kolkata Knight Riders Uniform : Sports & Outdoors

IPL Cricket KKR 2019 Jersey Supporter T Shirt RUSSELL 12 Custom Print Name No Kolkata Knight Riders Uniform(Russell 12, 44): Buy Online at Best Price in UAE - Amazon.ae

Kkr Original Team Kit Jersey Unboxing | Original Kkr Jersey Unboxing | Wrong Active Kkr Fan Jersey - YouTube

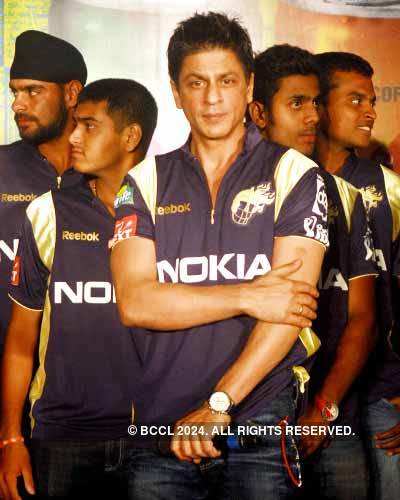

King Khan @iamsrk wearing Brand New Jersey of KKR #ipl #kkr #amiKKR #IPL2017 | Shahrukh khan, Brand new, Khan

Kolkata Knight Riders (KKR) Jersey - Buy Custom Printed Sports-Wear in Dubai UAE- Ministry Of Apparel

The Souled Store - KKR fans: What's better than an official Kolkata Knight Riders jersey? Winning an autographed one! All you have to do is tell us why you deserve this jersey,

Sports Jersey T Shirt Design Concept Vector Template, Cricket Jersey Concept for KKR Kolkata Knight Riders Jersey Stock Vector - Illustration of style, menswear: 214859150

WATCH: Dinesh Karthik unveils Kolkata Knight Riders' new jersey for Indian Premier League 2019 | Cricket News

ipl 2021 Jersey csk and kkr Jersey 2021 ipl (10-11 Years, CSK New & KKR New) : Amazon.in: Clothing & Accessories

IPL 2021: Revealed - Who Is This Beautiful Woman Spotted Wearing KKR Jersey During SRH vs KKR Match In Dubai