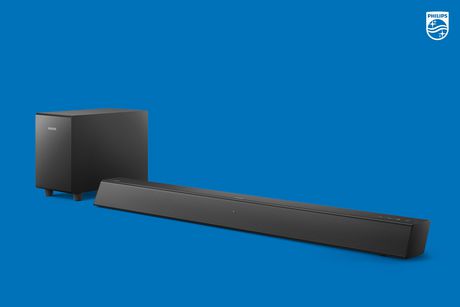

Philips Audio TAB5305 2.1CH 140W Bluetooth Soundbar with Wireless Subwoofer, Multiple Connectivity, Metal Grille and Powerful Bass Price: Buy Philips Audio TAB5305 2.1CH 140W Bluetooth Soundbar with Wireless Subwoofer, Multiple Connectivity, Metal

Philips TAPB603 3.1CH Dolby Atmos Soundbar with Wireless Subwoofer Price in India - buy Philips TAPB603 3.1CH Dolby Atmos Soundbar with Wireless Subwoofer online - Philips : VijaySales.Com

Philips B5306 2.1 Soundbar with Wireless Subwoofer, Bluetooth, HDMI ARC Support, 3.5mm Audio Jack and USB Port, TAB5306 | Walmart Canada

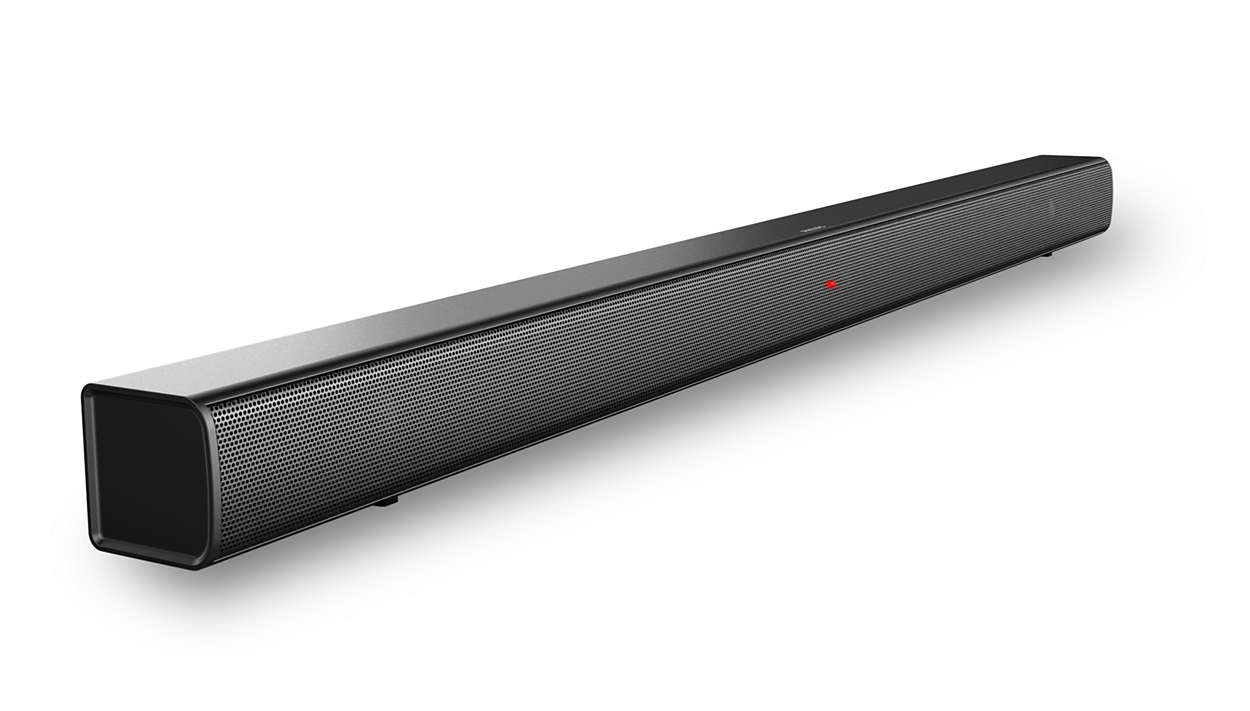

Philips | 2.1 CH Soundbar Subwoofer Bluetooth Wireless Speaker TAB5305/96 | HKTVmall The Largest HK Shopping Platform

Philips | 2.1 CH Soundbar Subwoofer Bluetooth Wireless Speaker TAB5305/96 | HKTVmall The Largest HK Shopping Platform

Amazon.com: PHILIPS Soundbar with Wireless Subwoofer, Home Theater Speaker System for TV, 2.1 Channel Sound Bars with Bluetooth Enabled Music Streaming : Electronics