مخادع شفاء يشفى الإملائية portafogli donna intrecciati multicolor san lorenzo - worthmoreministries.com

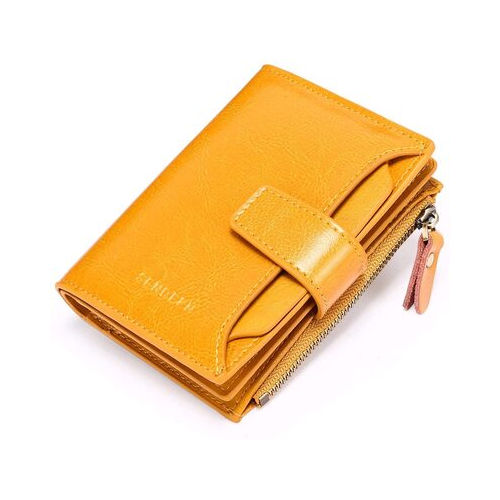

Elegante – Portafoglio da donna 100% in pelle con chiusura a scatto Jennifer Jones, rosso rubino (rosso) - 423 : Amazon.it: Valigeria

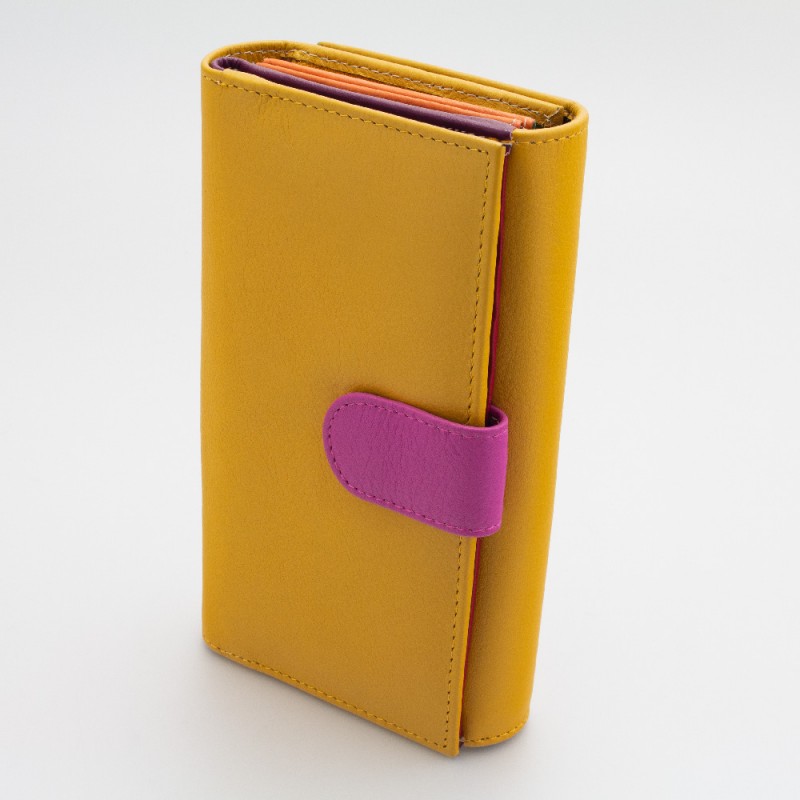

1353 portafoglio donna multitasche in pelle di agnello intrecciato chiusura con baccello, cm 10x18 | Bottega Fiorentina

PORTAFOGLIO donna vera pelle intrecciata e borchiato MADE IN ITALY – Glamour Accessories Shop – Borse in pelle e accessori di Artigianato Italiano – Caorle