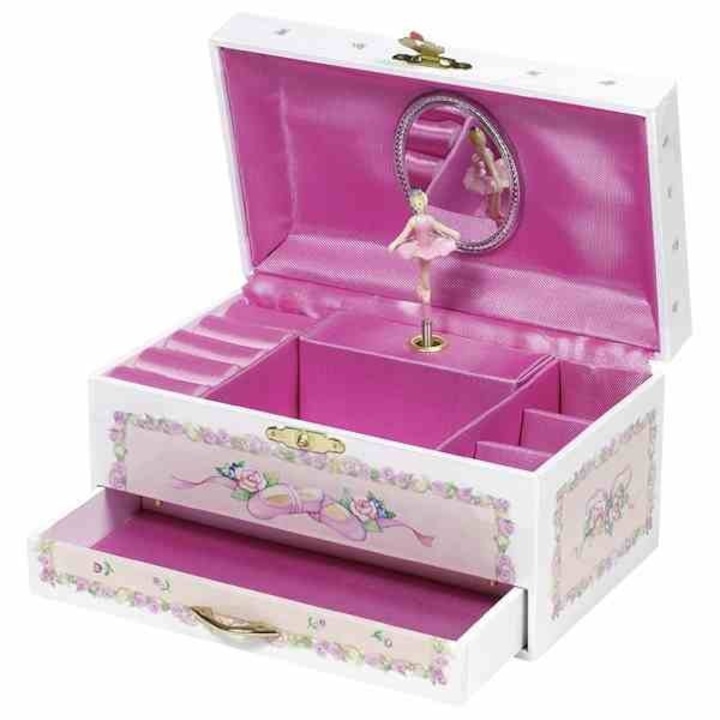

Ékszerdoboz kislánynak..,tükrös, fiókos, belső rekeszes. - Jewelry | Galeria Savaria online marketplace - Antiques, artworks, home decor items and collectibles

Minden kislány álma egy balerinás zenedoboz. Amikor kinyitod a dobozt, a balerina táncolni kezd és zenél./ /Zene: … | Nostalgic toys, Music box ballerina, Music box

Ékszerdoboz kislánynak..,tükrös, fiókos, belső rekeszes. - Jewelry | Galeria Savaria online marketplace - Antiques, artworks, home decor items and collectibles