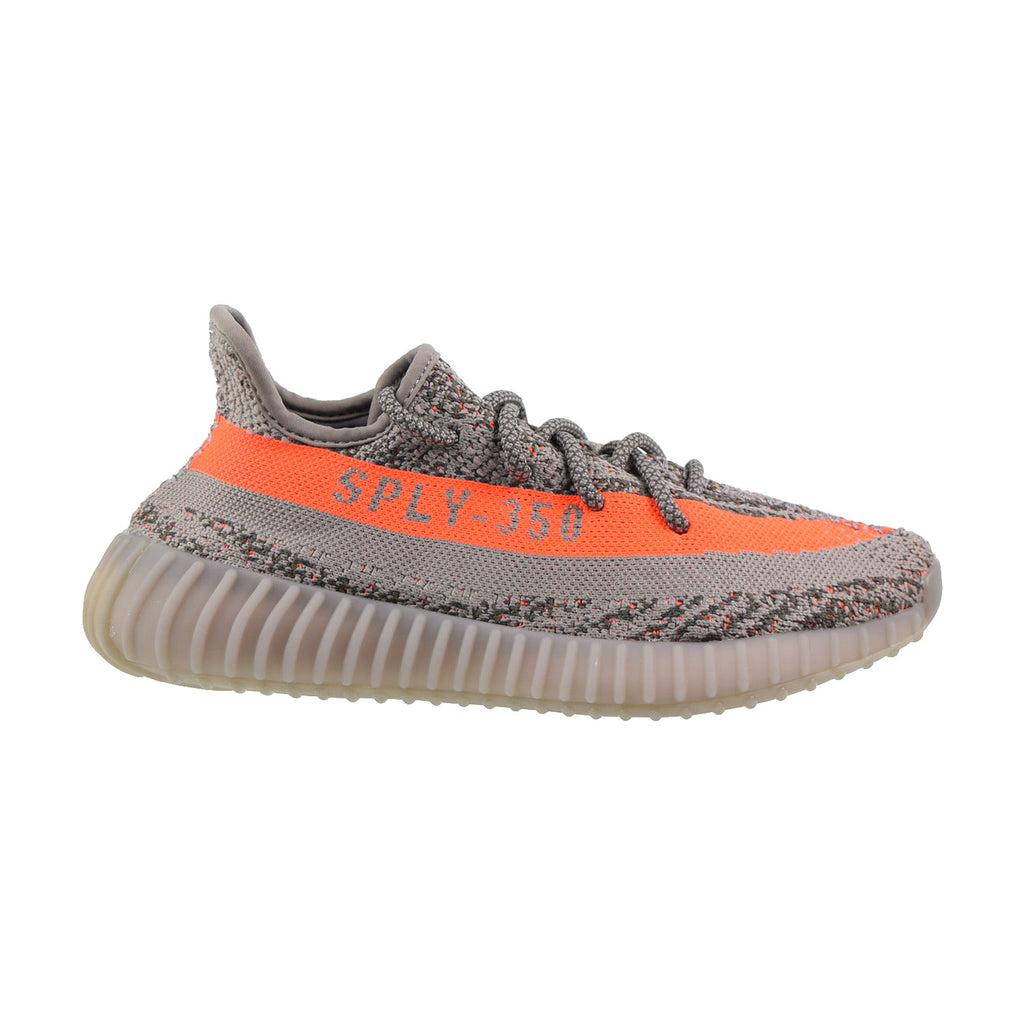

ADIDAS | YEEZY BOOST 350 V2 BELUGA RF / STEEPLE GREY / SOLAR RED for Sale in Hialeah Gardens, FL - OfferUp

StockX - "Steeple Gray" Yeezy 350 V2 https://stockx.com/sneaker-blog/adidas -yeezy-boost-350-v2-steeple-gray-beluga/ | Facebook

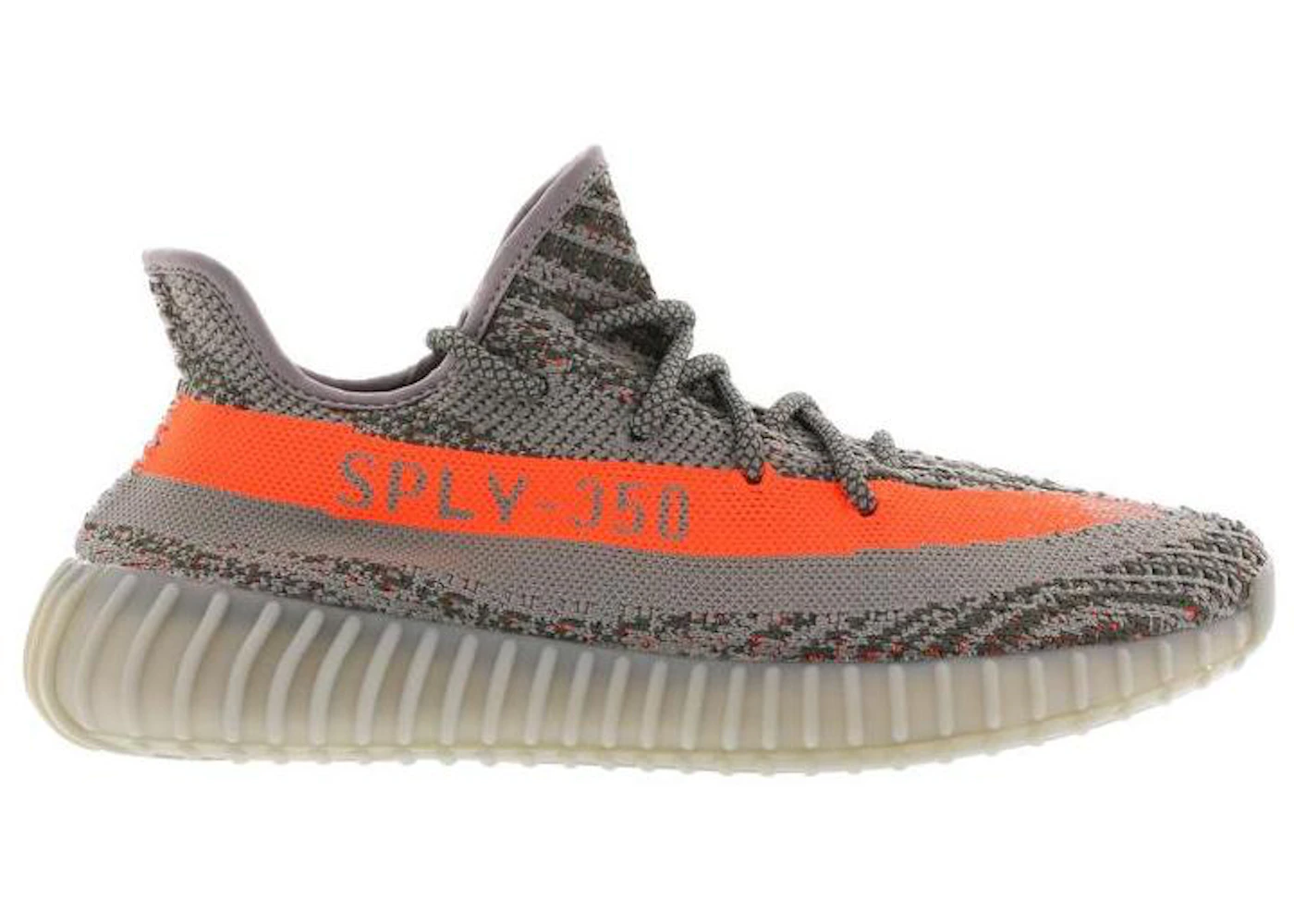

Adidas Yeezy Boost 350 V2 (Beluga Reflective/ Grey/ Beluga Reflective/ Steeple Gray/ Solar Red) Men | Kixify Marketplace