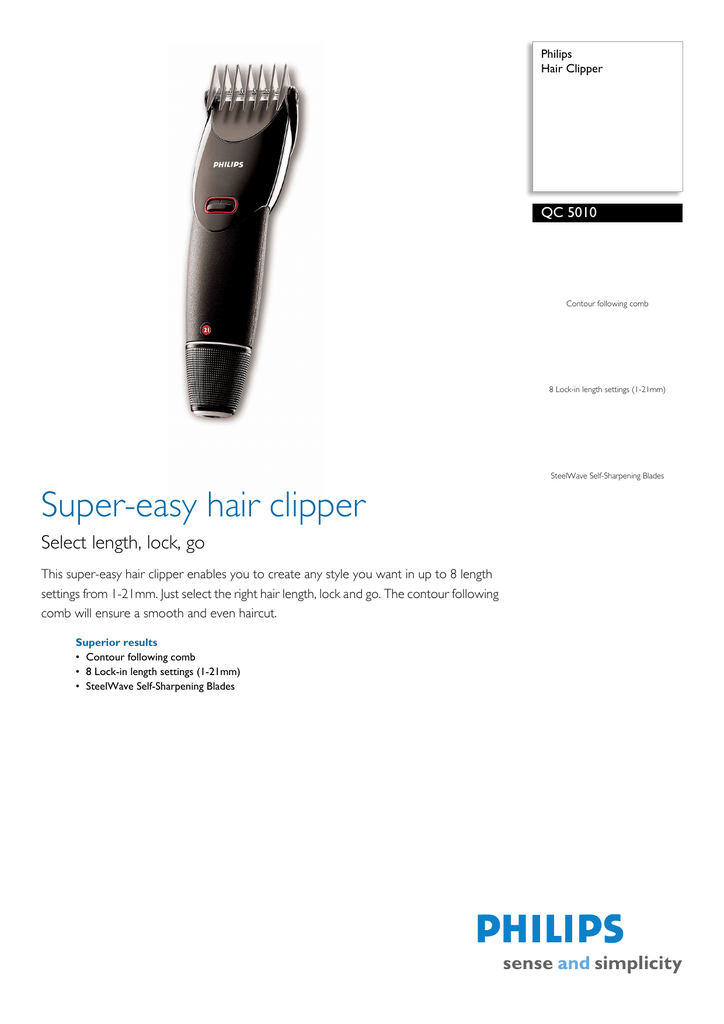

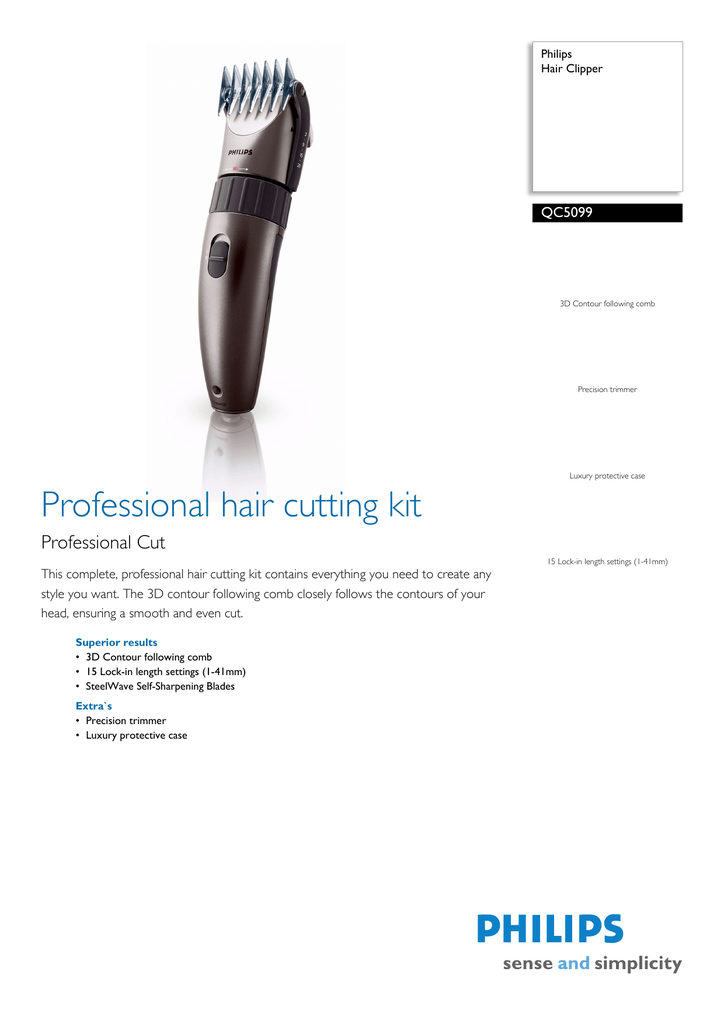

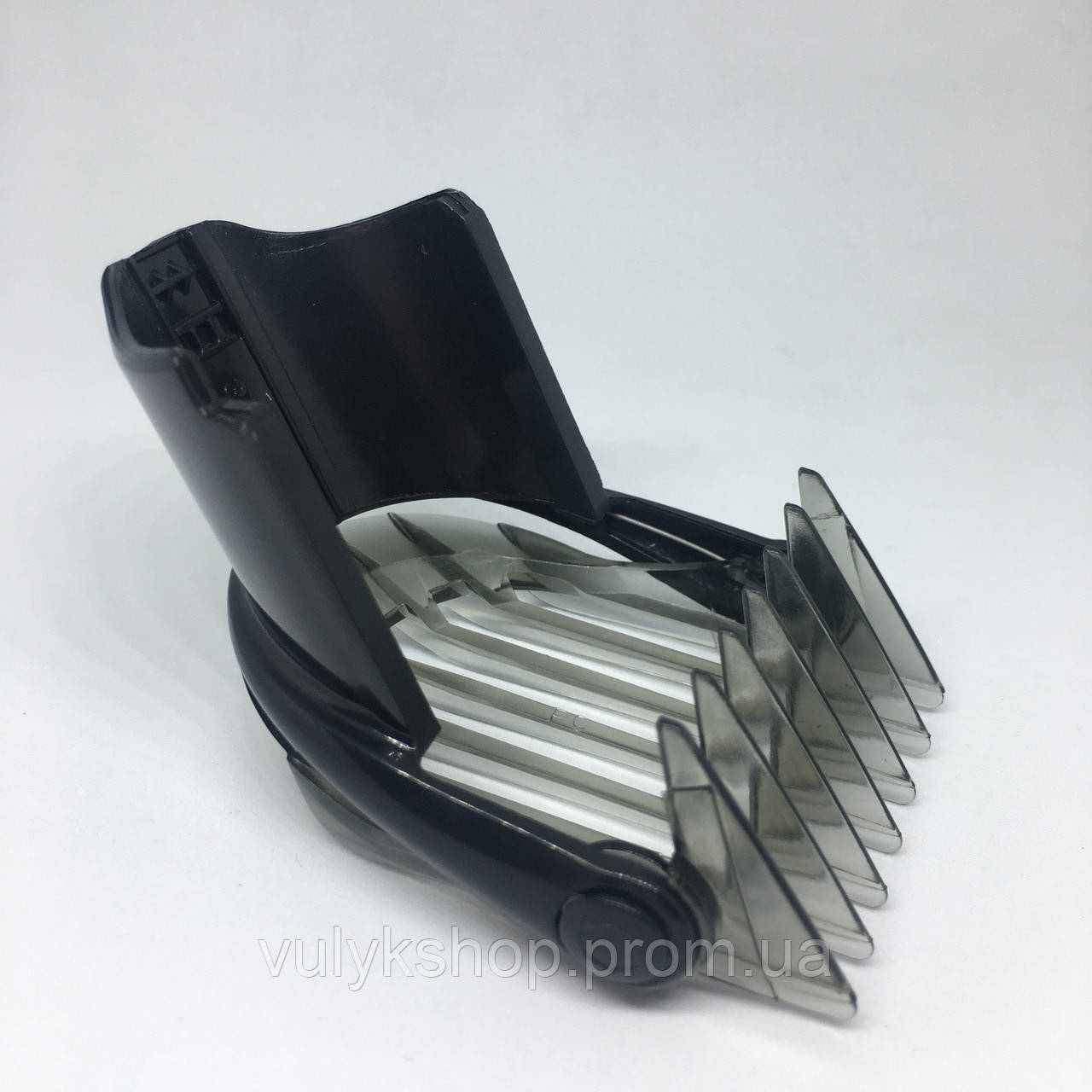

Replacement Hair Clipper Comb Attachments for Philips, Hair Trimmer Guards for Philips QC5010 QC5050 QC5053 QC5070 QC5090, 3-21MM: Buy Online at Best Price in UAE - Amazon.ae

Cumpără ILY-Clipper Trimmer Pieptene atașament pentru Philips Shaver QC5010 QC5050 QC5070 QC5090 la prețuri mici — livrare gratuită, recenzii cu poze reale — Joom

Насадка регулировки длины волос для машинки для стрижки Philips QC5010, QC5050, QC5090, 420303553330,CRP316/01, цена 210 грн — Prom.ua (ID#1622479283)

Насадка Регулювання Довжини Волосся для Машинки Philips QC5010, QC5050, QC5090, 420303553330,CRP316/01 — Купити Недорого на Bigl.ua (1622479283)

PHILIPS QC5090 HAIRCLIPPER Service Manual download, schematics, eeprom, repair info for electronics experts

Philips Standardkamm QC5010 QC5050 QC5070 QC5090 252111-420303553330 CRP316/00 günstig kaufen bei - ErsatzteilDIRECT.de

For Philips Hair Clipper Comb Small 3-21mm Qc5010 Qc5050 Qc5053 Qc5070 Qc5090 Guide Combs - Nose & Ear Trimmer - AliExpress

Amazon | WuYan 交換用 ヘアクリッパーコーム アタッチメント互換性 Philips用 ヘアトリマーガード 互換性 Philips Qc5010 Qc5050 Qc5053 Qc5070 Qc5090, 3-21Mm用 | WuYan | バリカン・ヘアカッター 通販

3-21mm Hair Clipper Attachment Grooming Comb for Philips QC5010 QC5050 QC5070 QC5090 - Price history & Review | AliExpress Seller - Ideas For Life Store | Alitools.io