صور لمشغل الموسيقى arabic, الكثير من معارض الصور الكثير من على Alibaba.com, صورة مشغل الموسيقى arabic

.jpg)

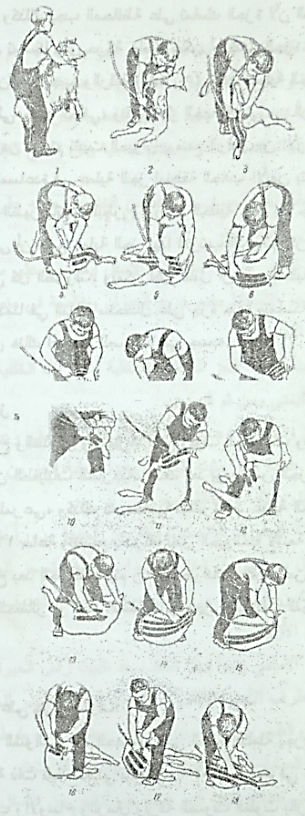

صور.. موسم "الجلامة" جز صوف الأغنام فى مطروح.. طقوس تراثية واحتفالات وولائم.. والمربون يحرصون على قص صوفها قبل بداية الصيف بمساعدة المتطوعين.. ومصنع الصوف يحوله إلى خيوط لاستخدامها فى الصناعة اليدوية منزليا -

مقصات الأغنام الكهربائية، ماكينة حلاقة كهربائية من مقص الأغنام مع آلة تمزيق كهربائية عالية القوة، تستخدم لتمزيق الأغنام والماعز والألباك واللاما والكلاب الكبيرة وأرانب الأنجورا. : Amazon.ae: أدوات وتحسين المنزل