Amazon.com | Water Shoes Men,Mens Water Shoes,Water Shoes Women,Barefoot Shoes,Quick Dry Aqua Swim Shoes,Slip-on Soft Beach Shoes,Quick Dry Water Shoes,Aqua Sports Outdoor Shoes for Pool Beach Surf Walk Water Yoga | Water

Amazon.com | Water Shoes Men,Mens Water Shoes,Water Shoes Women,Barefoot Shoes,Quick Dry Aqua Swim Shoes,Slip-on Soft Beach Shoes,Quick Dry Water Shoes,Aqua Sports Outdoor Shoes for Pool Beach Surf Walk Water Yoga | Water

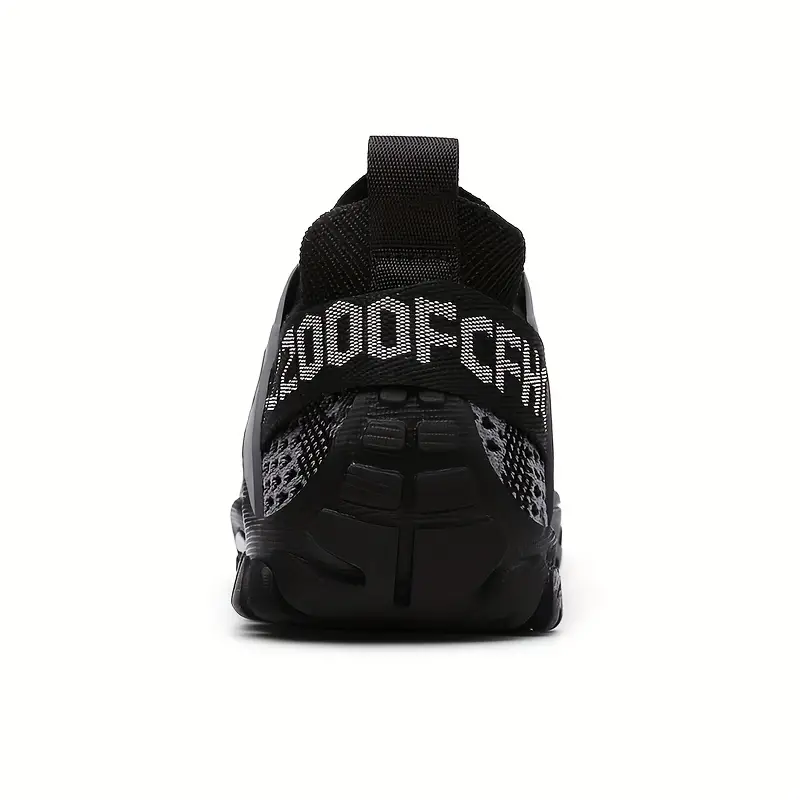

Men Women Quick Dry Barefoot Water Shoes Comfortable Breathable Beach Seaside Wading Shoes Trekking Upstream Surfing Aqua Shoe

adidas Launches the Parley Pack – Its First Football Boot Pack Designed to Help Reduce Plastic Waste