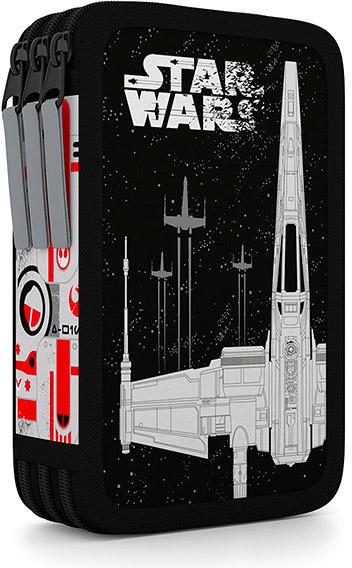

Vásárlás: Star Wars 3 emeletes töltött tolltartó - fekete (ASN5089) Tolltartó árak összehasonlítása, Star Wars 3 emeletes töltött tolltartó fekete ASN 5089 boltok

Star Wars felszerelt emeletes tolltartó - Crush the Resistance - Gyerekjatekwebaruhaz.com - Gyerekjátékok nagy választékban!

Star Wars felszerelt emeletes tolltartó - Crush the Resistance - Gyerekjatekwebaruhaz.com - Gyerekjátékok nagy választékban!