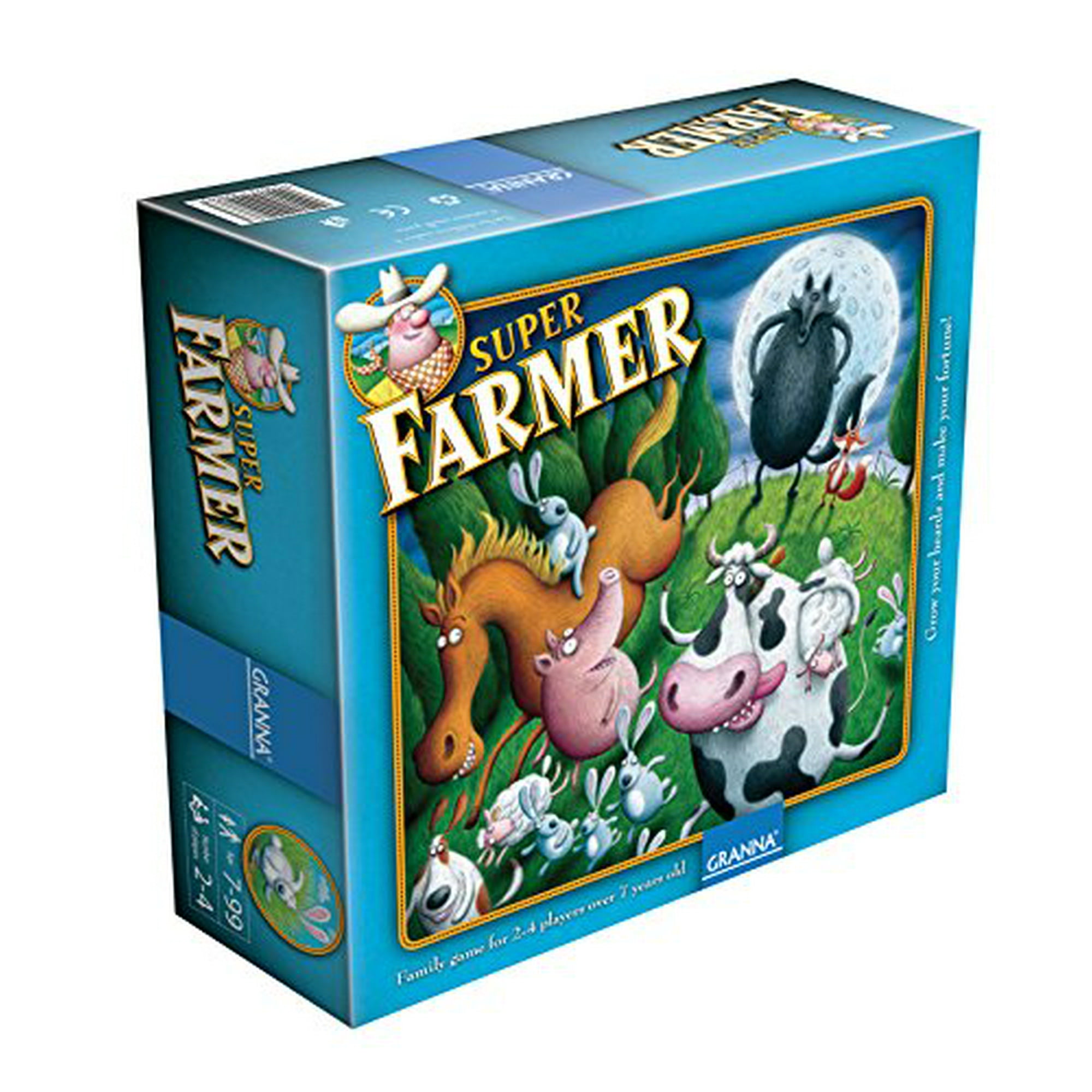

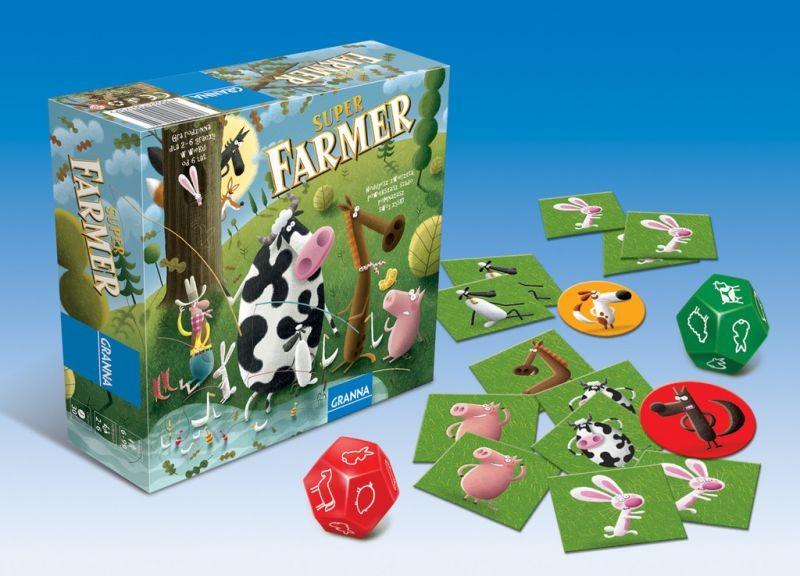

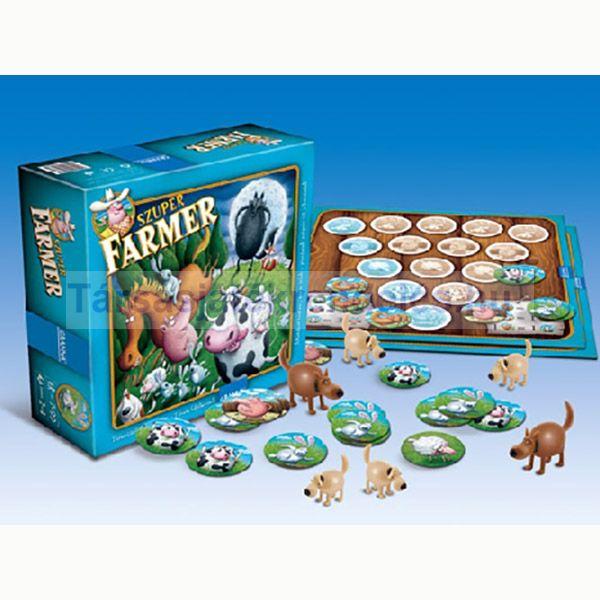

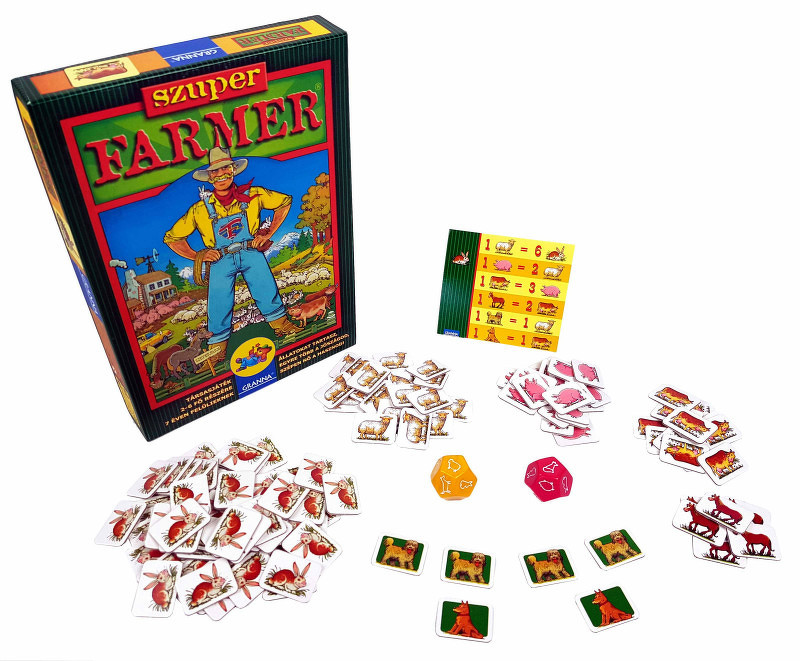

Vásárlás: Granna Szuper Farmer - közepes méretű változat Társasjáték árak összehasonlítása, Szuper Farmer közepes méretű változat boltok

Vásárlás: Granna Szuper Farmer Extra (03086) Társasjáték árak összehasonlítása, Szuper Farmer Extra 03086 boltok

Jeges Dbs Blyth Baba Játék Ruha A Jeges Közös Test Ruhát Hacukában Nagy Nadrág, Farmer, Fehér Póló Játék rendelés \ Babák & Plüss Játékok | Vgihp.shop

Új Granna Szuper Farmer Extra társasjáték gyerek játék társas fiú lány - Mosonmagyaróvár, Győr-Moson-Sopron

/pic1802593.jpg)